Listen to the Podcast

Microprudential authorities are beginning to take climate-related risks into account and to reflect them as part of their supervisory principles and practices. However, there is not yet a well-developed macroprudential framework to address climate-related financial risks. This Toronto Centre Note and podcast examine how macroprudential approaches can be adapted to address climate-related financial risks. Read the bios here. Read the transcript here.

Read the Toronto Centre Note

ADAPTING MACROPRUDENTIAL FRAMEWORKS TO CLIMATE CHANGE RISKS

Introduction[1]

Climate change poses one of the most significant risks to humanity. It threatens environmental disaster, economic wellbeing, food supply, income inequality, development goals and national security. The economic and environmental consequences of climate change will have an adverse impact on the value of real and financial assets, the balance sheets and risk profiles of financial intermediaries, and the functioning of markets. Climate change creates systemic risk and poses a threat to financial stability.[2] The Central Banks and Supervisors Network for Greening the Financial System (NGFS) has called for the “integration of climate-related risks into financial stability monitoring and micro-supervision”.[3]

Microprudential authorities are beginning to take climate-related risks into account and to reflect them as part of their supervisory principles and practices.[4] Consideration is being given to the role of central banks in addressing the risks posed by climate change, including as part of their financial stability mandates.[5] The IMF is exploring how to incorporate the macro-financial aspects of climate into their financial sector assessment program (FSAPs).[6] However, there is not yet a well-developed macroprudential framework to address climate-related financial risks. This Toronto Centre Note examines how macroprudential approaches can be adapted to address climate-related financial risks.

The macroprudential framework proposed in this Note derives from the feedback loops between the financial system and climate change: climate change creates risk for the financial system, which in turn contributes to climate change, through the misallocation of financial resources. The misallocation of financial resources – the overfinancing of “brown”, high greenhouse gas (GHG) emitting assets – occurs because asset prices do not reflect the social costs of climate change. This makes it more difficult to meet national climate goals, which creates systemic risk for the financial system.

Under the proposed framework, macroprudential authorities would assess the consistency of financial flows with national commitments under the Paris Climate Agreement (PCA) and recommend polices that can bring the flows into line with those commitments. Meeting the PCA commitments will reduce the potentially catastrophic financial risks from climate change and is consistent with the macroprudential objective of mitigating systemic risk.

These proposed assessments would be an additional component of macroprudential and financial stability analysis. They would provide critical inputs into stress testing and financial stability analysis; complement microprudential supervision of climate-related risks; and help to guide policies to mitigate the risks of climate change.

Section 2 of the Note discusses the financial risks posed by climate change and the current micro and macroprudential approaches for addressing these risks. Section 3 outlines the proposal to adapt macroprudential frameworks. Section 4 concludes.

Financial policies and climate change

Climate change poses a unique challenge for financial analysis and for designing appropriate financial policies to mitigate the risks from climate change. Carney (2015) characterized the problem as the “tragedy of the horizon”. While the physical risks of climate change will be felt over a long-time horizon with potentially massive costs to future generations, the time horizon over which markets, economic agents and policy makers act is much shorter. For example, financial stability assessments, supervisory stress tests and risk-based supervisory frameworks usually have a time framework of 3-5 years.

Nevertheless, there is an increasing acknowledgement that climate change poses a threat to financial stability. This was recognized, for example, in the creation of the NGFS in 2017. National financial stability assessments are also beginning to incorporate climate risk into their analysis.[7] In recognition of the risks posed by climate change, in 2021 the Financial Stability Board (FSB) published a road map to address climate-related financial risks.[8]

Climate-related financial risks differ from risks that are normally the subject of financial stability analysis and macroprudential policy in several respects:

- Risks to the financial system from climate change tend to be particularly uncertain in both their severity and the time horizon over which they materialize. The risks are expected to materialize over longer time horizons. There are limited data to model the risks.

- The effects of climate change may be far-reaching and potentially economically and socially catastrophic in their breadth and magnitude. Climate change could affect a wide variety of firms, sectors and geographies in a highly correlated manner. The interactions between the social and economic consequences of climate change are poorly understood.

- Different types of climate-related risks may materialize simultaneously, amplifying their effects. The interactions are likely to be subject to complex non-linearities and tipping points that are impossible to model.

- In view of their potential breadth and magnitude, climate-related risks are largely unhedgeable, and their impact irreversible.

Types of financial risks posed by climate change

The nature of the risks to financial stability from climate change are often categorized into physical risks and transition risks.

- Physical risks are those associated with the damage of climate change on physical assets, for example from extreme weather events and sea level rise.

- Transition risks are those associated with the transition to a lower carbon emissions economy, which would have an impact on the value of assets, the viability of industries and sectors, and the solvency of regions and national economies. Transition risks lead to concerns about so called “stranded assets” – assets that would lose their value in the transition to a low carbon economy.

Important interdependencies may exist between physical and transition risks. For instance, if the transition is slow at first, this may increase the probability that physical risks will materialize. In turn, sharp increases in economic losses from weather-related events may trigger more abrupt policy responses, leading to higher transition risks.

A third type of financial risk from climate change is associated with catastrophic tipping points due to potential non-linearities and feed-back mechanisms. These risks have been characterized by Bolton et al (2020) as “green swans”, with many of the characteristics of “black swans” that are familiar in the literature on financial crises. Black swans are rare and unpredictable events that can trigger systemic financial crises due to complex interactions and are associated with fat tails in probability distributions. The main difference between green and black swans is the high probability that a combination of physical and transition risks from climate change will materialize in the future and interact in complex ways, resulting in fundamentally unpredictable environmental, geopolitical, social and economic dynamics.

Microprudential risks

Climate change poses additional risks to individual financial institutions (microprudential risks) such as:

- Operational risk, affecting all institutions and the financial infrastructure, from potential disruptions of operations due to the increased incidences of climate-related events.

- Credit risk, especially for banks, from the impact of climate change or climate change-related policies on the creditworthiness of borrowers.

- Liability risk, most notably for insurers, due to the increased exposure to unexpected losses because of climate-related events.

- Market and asset price risk, affecting pension funds, insurers, asset management companies and banks, due to the impact of climate change or climate-related polices on asset values.

- Liquidity risk, from the impact of climate change on the depth of markets in climate sensitive assets.

- Reputation risk, because of exposures to carbon intensive sectors and assets.

Macroprudential risks

In addition to the microprudential risks, climate change creates macroprudential risks. Macroprudential risks are systemic risks that threaten the financial system and the real economy. Systemic risk is defined as an impairment or disruption to the flow of financial services, that would have the potential to have a serious negative impact on the real economy.[9]

Systemic risk is associated with feedback loops between the financial system and the real economy. Two types of feedback loops received particular attention in the wake of the global financial crisis (GFC) of 2008: procyclicality in financial systems and systemically important financial institutions (SIFIs).[10]

Procyclicality refers to the situation where the financial sector amplifies the impact of shocks on the real economy. Procyclicality could arise from both the physical and transition risks posed by climate change. For physical risks, an example would be where an increase in the risk of flooding from rising sea levels leads to a reduction in the availability of insurance against severe weather events. The withdrawal of the coverage reduces the value of collateral (house prices in flood prone areas) and as a result banks withdraw credit from the sector, leading to a downturn in economic activity.

For transition risks, an example of procyclicality would arise from the currently inflated value of brown assets that would be subject to correction as economies price in the global warming costs of brown assets. If the correction in the value of brown assets leads to a sharp reduction in lending it could have macroeconomic effects. The risks of a disorderly correction are likely to increase as the adjustments of industry and finance to reach net zero emissions targets accelerate (the so-called “cliff effects”).[11]

Systemically important financial institutions (SIFIs) are financial institutions whose failure, due to their size, interconnectedness, or lack of substitutability, would have systemic consequences for the real economy. An example of how climate change could have an impact on SIFIs would be if it were to create a contagion channel that would increase the risk of joint failures in financial institutions, thereby increasing the potential impact on the real economy. Such joint failures could result from common exposures to brown asset classes that would be subject to losses in the transition to a low carbon economy.

Another source of systemic risk highlighted by the GFC is the growth of unregulated financial institutions that could become systemically important. This is also a potential source of systemic risk with regards to climate change. The concern is that the attention to green finance among regulated institutions, including through the adoption of new climate-related financial regulations, will result in the migration of brown finance to the unregulated sector. This raises three concerns: (1) the transition to a green economy may be muted by the unregulated sector; (2) the risks of brown finance will be unregulated; and (3) the unregulated brown finance sector will become systemically important and increase the risk that a correction in the pricing of brown assets would have systemic consequences.

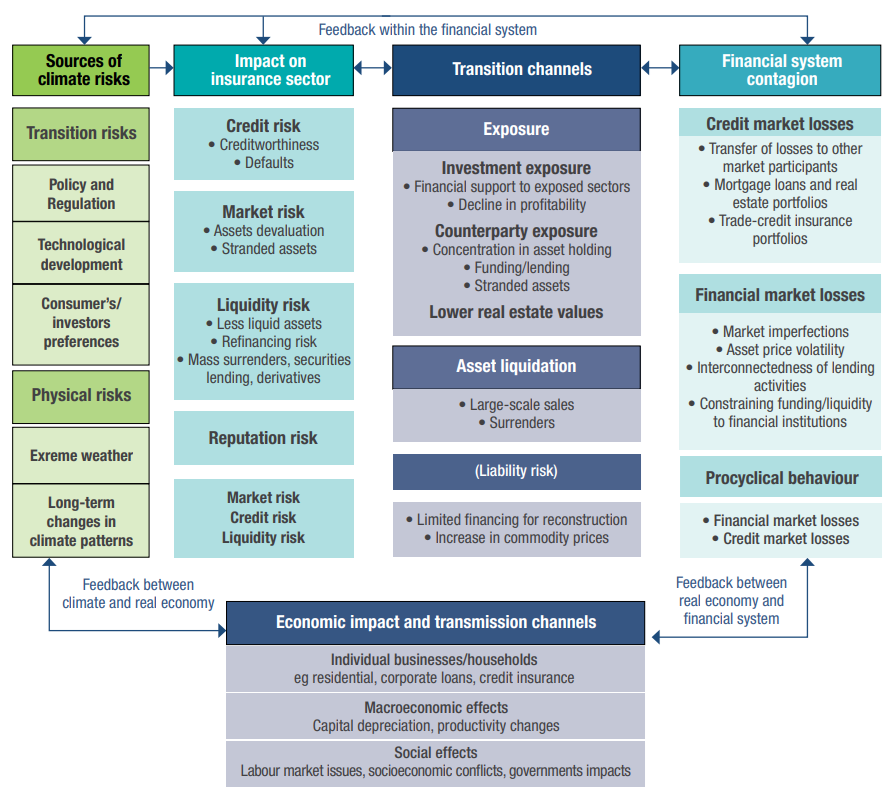

The following chart provides a summary of some of the channels through which climate change can create micro and macroprudential risks.

Transmission through which climate change can create micro and macro-financial risks

Source: IAIS (2021b)

Difficulties of reflecting risks from climate change in financial analysis

Notwithstanding the above discussion on how climate change can create risk in the financial sector, there are numerous difficulties in taking account of these risks in public sector policy and private sector decision making.

The first, and most fundamental, difficulty is that markets do not incorporate a price for climate change. Climate change is an externality: without government intervention, the private cost, for example of burning fossil fuels (for example the price of petrol at the pump), does not reflect the cost to society from the release of GHG in contributing to climate change. Products that generate high volumes of GHG will be underpriced in private markets compared to their social costs. Governments can address this market failure through, for example, imposing taxes on products that reflect the amount of GHG emitted, for example through carbon taxes. However, while such taxes are recognized to be the first best solution to address climate change, for various reasons many countries have found them difficult to implement in practice. As a result, the private sector, including financial institutions, make decisions based on prices that do not fully reflect the social costs of climate change.[12]

The second difficulty, in the absence of appropriate pricing of GHG emissions, is that even if the private sector were to consider the costs of climate change in their decisions, reliable information on which to base those decisions is currently lacking. The problems are twofold. First, the absence of a generally accepted taxonomy to distinguish between green and brown assets. Of course, there are obvious distinctions – for example, coal-generated electricity compared with solar power – but there can also be complex accounting issues in identifying GHG emissions when taking account of the total value chains involved in the extraction, production, transportation and marketing of different products. Second, information gaps and the lack of transparency in disclosures by corporations of their carbon footprints.

The international community is prioritizing the need to address the gaps in climate-related financial information, including through the establishment of the Task Force on Climate Related Financial Disclosures (TCFD)[13] and the creation of the Sustainability Accounting Standards Board (SASB). The former aims to develop voluntary, consistent climate-related financial risk disclosures for use by companies, banks and investors; and the latter proposes standards for the reporting of non-financial, environmental, social and governance (ESG) metrics.[14]

The third difficulty is the lack of historical data with which to model the risks posed by climate change. Extrapolating historical trends can only lead to mispricing of climate-related risks, as these risks have barely started to materialize. Thus, standard approaches to modelling financial risk using statistical techniques cannot be used. This problem has been termed an “epistemological obstacle” to the assessment of risks posed by climate change.[15] Consequently, statistical analysis of the risks posed by climate change has been replaced by the development of scenario analysis intended to highlight the risks under different potential paths for emissions and climate change.

The NGFS distinguishes four main climate scenarios, with escalating severity, to highlight the transition and physical risks from climate change, and has developed detailed quantitative information for the first three of these scenarios.[16]

- An orderly (early, ambitious) transition, consistent with a temperature increase of 2°C by 2100. This is the mildest scenario.

- A disorderly (late, disruptive action) transition, consistent with the same temperature increase but amplifying transition risk.

- A “hot house world” scenario consistent with a temperature increase of close to 4°C by 2100 and little or no transition policy, which focuses on physical risk.

- A “too little, too late” scenario which can be considered a worst-case scenario that exhibits both transition and physical risk.[17]

Scenario analysis has limitations.[18] First, the materialization of physical and transition risks depends on multiple non-linear dynamics that are extremely difficult to reflect in the scenarios in a general context and even more difficult at the granular level needed to make assessments of specific risk exposures. Various methodological approaches are being explored, and this is a field of research that is undergoing rapid development. Second, the absence of a framework for mitigating the risk: climate risk is essentially unhedgeable as climate change is likely to have an impact on a very broad set of assets and there are presently too few climate-risk-free assets in which to invest. The absence of climate risk hedges places a distinct limit on what the scenario analysis can identify in terms of actions to mitigate climate risk.

Responses to the risks posed by climate change

Microprudential responses

The international supervisory standard setters are responding to the risks posed by climate change by updating their supervisory standards and guidance.

- In 2021 the Basel Committee of Bank Supervisors (BCBS) published for discussion principles for the effective management and supervision of climate-related financial risks.[19]

- The International Association of Insurance Supervisors (IAIS) and the Sustainable Insurance Forum (SIF) published, also in 2021, an Application Paper on the Supervision of Climate-related Risks in the Insurance Sector.[20]

The BCBS and IAIS-SIF guidance cover issues including corporate governance and internal controls; approaches to risk management, solvency and liquidity; the use of scenario and stress testing; and the roles of supervisors and disclosures in mitigating climate-related financial risks.

- The International Organization of Securities Commissions (IOSCO) has developed recommendations regarding sustainable financial instruments and disclosure requirements of ESG‐specific risks, highlighting the lack of sustainability-related disclosure and definitions, and other challenges to investor protection.[21]

- The NGFS has developed guidance and is monitoring the progress of national supervisory authorities in responding to the risks posed by climate change.[22]

- The Toronto Centre issued a climate risk toolkit for financial supervisors.[23] The toolkit elaborates on the above initiatives and discuses gender related concerns associated with climate-related risks.

Macroprudential response

The FSB road map to address climate-related financial risks identifies four areas:

- Firm-level disclosures, as the basis for the pricing and management of climate-related financial risks at the level of individual entities and market participants;

- Data, using consistent metrics and disclosures, for the diagnosis of climate-related vulnerabilities;

- Vulnerabilities analysis, to provide the basis for the design and application of regulatory and supervisory frameworks and tools; and

- Regulatory and supervisory practices and tools that allow authorities to address identified climate-related risks to financial stability in an effective manner.[24]

The road map does not discuss a macroprudential policy response to the risks posed by climate change, but notes the need for “ongoing consideration of …. additional macro prudential tools to address additional issues impacting financial stability that may be identified”.[25] One of the reasons is the deep uncertainty about the precise macroprudential risks and the appropriate macroprudential response. The emphasis is therefore on information enhancement, vulnerability analysis and increased firm level attention to climate risks, supported by regulatory and supervisory actions.

Some other authors have considered what a macroprudential response to climate change might entail. Climate-risk adjusted capital requirements represent by far the most discussed policy tool.[26] A ‘green supporting factor’ (GSF) or a ‘brown penalizing factor’ (BPF) could be applied to the minimum capital requirements, respectively lowering risk weights to climate-friendly (green) investments or raising risk weights on carbon-intensive investments. Generally, a BPF is preferred, allowing for the integration of the added ‘carbon risk’ to overall risk-return assessments. A higher risk weight for loans carrying carbon risks could take account of the systemic risk of investing in high-carbon activities and may discourage further brown investments. It could also help build banks’ capital reserves to withstand losses from climate-related transition risks.

A form of the counter-cyclical capital buffer (CCyB) for climate risks has also been proposed.[27] The concept is that the financial system is currently in the middle of a very long upward cycle in providing credit to carbon intensive sectors, and that cycle will eventually come to an end as the PCA targets are implemented. To build up additional capital buffers in anticipation of the transition risks to a low carbon economy, an additional capital add-on for carbon risks could be applied.

Another proposal is to include exposures to carbon intensive assets as an additional criterion in SIFI identification. Exposures to carbon intensive assets could increase the risk of contagion among financial institutions as these assets could become “stranded” as part of the transition to low carbon economy, increasing the risk of collective failures in institutions with high exposures to these assets, creating systemic risk.

One of the difficulties with these proposals is in their design and quantification, since there is no historical information on which their application can be based. In addition, there are questions about their likely effectiveness and potential to have unintended consequences (see the next section). As regards SIFI identification, the existing framework already provides scope to take account of common exposures that could result in contagion.

Adapting macroprudential frameworks to climate change risks

The frameworks for macroprudential analysis have evolved over time to address prescient financial stability concerns. For example, early analysis in the 1970s and 1980s examined how countries could liberalize their financial systems and avoid financial crises.[28] In response to the financial crises of the 1980s and 1990s, central banks began to develop approaches to assess financial system vulnerabilities and the IMF and World Bank initiated FSAPs.[29] The GFC of 2008 highlighted the weaknesses in microprudential regulatory approaches and provided the impetus for a broad adoption of macroprudential frameworks and the development of macroprudential tools. This section discusses how macroprudential frameworks can evolve further to address the financial risks from climate change.

New challenge of climate change and the need to adapt the macroprudential framework

Climate change poses a new macroprudential challenge. Macroprudential frameworks are concerned with two issues: systemic risk identification and systemic risk mitigation (preventing financial crises). As discussed above, the unique aspects of climate change make both of these issues very difficult: financial risks will materialize over long time horizons and involve extreme uncertainty. Nevertheless, there is a high degree of certainty that if climate targets are not met, the risks will materialize, and most likely in the form of a catastrophic green swan event. The challenge is how to formulate a macroprudential framework and macroprudential policy to address this conundrum.

Systemic risk involves the risk that an impairment or failure in the financial system has a significant negative impact on the real economy. In viewing the sources of systemic risk, it is necessary to take into consideration:

- The impact of climate change on the financial system;

- The impact of the financial system on climate change; and

- Feedback loops between climate change and the financial system that may amplify these impacts and become a source of instability for the financial system and the real economy.

The last consideration should be the primary concern of macroprudential policy.

The financial system impacts climate change primarily through the allocation of its financial portfolio, and whether and to what extent it supports green as opposed to brown activities. The financial system is the main channel for the allocation of financial resources in the economy. The channels include the lending policies of banks, and the asset allocations of pension, insurance and asset management companies. The climate targets are unlikely to be achieved unless they are supported by the allocation of resources through the financial system. The failure to meet those targets will create systemic risk.

The definition of systemic risk – an impairment or disruption to the flow of financial services that has negative consequences for the real economy – was developed following the GFC to address the shortcomings in microprudential supervisory arrangements in preventing financial crises. The pre-GFC microprudential frameworks did not take account of the externalities in the financial system, focusing only on the risks in individual institutions, markets or instruments, and not the potential spillover effects.

While some of the systemic risks posed by climate change have characteristics similar to those considered in the wake of the GFC, the systemic risks of climate pose a challenge of a different order: the challenges of risk identification and mitigation in the face of extreme uncertainty and long-time horizons. In this context, the concept of “impairment” in the flow of financial services requires an interpretation consistent with the feedback loops between the financial system and the risks posed by climate change that emerge over a longer time horizon. Flows of finance contribute to systemic risk (green swans) if they do not support the climate goals. The misallocation of financial resources can be considered an “impairment” and a macroprudential concern.

An adapted macroprudential framework

The following propositions elaborate on the reasoning and the proposal to adapt macroprudential frameworks to address the systemic risks posed by climate change.

Proposition 1: The best strategy to mitigate the systemic financial risk of climate change is to meet the GHG emission targets, as committed to by national authorities under the PCA. This would avoid the worst consequences for society, economies and financial systems. Meeting the targets would lessen the probability of reaching tipping points and confronting green swans.

Proposition 2: The financial sector is the economy’s main engine to allocate resources to their most productive use and to distribute risks efficiently. The financial sector should play a central role in making financial flows more consistent with the transition towards a climate‐resilient and low‐carbon economy and meeting the national goals established under the PCA. If the financial flows are inconsistent with the climate goals it is highly unlikely that the climate goals can be reached.

Proposition 3: Current asset pricing does not reflect the social costs of GHG emissions in contributing to climate change, either because carbon pricing is incomplete or other policies are not fully effective in reflecting these social costs. Financial systems are, therefore, likely to be inefficient in allocating financial resources consistent with the climate goals.

Proposition 4: The inefficient allocation of financial resources will favour brown over green investments and increase the risk of overshooting the climate goals.

Proposition 5: By increasing the risk that the climate targets will not be met, the misallocation of financial resources contributes to systemic risks (green swans) and is thus a macroprudential concern.

A macroprudential framework to address the systemic risks posed by climate change should therefore be concerned with the structure of financial flows and whether they are consistent with and supportive of meeting the GHG emissions targets. This is consistent with Article 2.1.c of the Paris Agreement, which aims to “mak[e] finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development" (UNFCCC (2015)). As noted by the FSB (2020b), a gradual and well-anticipated transition to a low-carbon economy has a relatively contained impact on asset prices and is less likely to have material implications for financial stability.

The macroprudential framework would have as an objective the consistency of financial flows with the national climate targets and strategies. This approach would embed the macroprudential framework within the broader national strategy for meeting climate goals and provide a macro-financial perspective in the design and implementation of those goals.

The proposed adaptation has a further benefit in that it helps to address “the tragedy of the horizon.” Rather than trying to “look through the glass darkly” in an attempt to understand the risks in a context of extreme uncertainty, the task becomes one of assessing whether the current structure of financial flows is consistent with, and supportive of, the national climate targets and, if necessary, recommending polices that can bring the flows into consistency with the climate goals. The climate goals and targets are established over shorter time horizons and in the context of specific GHG mitigation strategies.

The proposed adaptation of the macroprudential frameworks would be an additional component of macroprudential and financial stability assessments. It would complement rather than replace other aspects of such assessments.

Elements involved in the assessments

The key challenge in preparing the assessments will be to link the financial asset and loan composition to the climate targets. The steps in the process could involve the following:

- Calculating the total carbon budget consistent with meeting the climate objective, and translating this into national GHG emissions targets;

- Calculating the current level of emissions and necessary adjustment to meet the emissions targets;

- Estimating the contributions of different sectors, industries and firms to emissions;

- Linking the loan, asset and balance sheet composition in the financial system to the emissions of different sectors, industries and firms;

- Evaluating the necessary adjustment in the loan, asset and balance sheet composition consistent with achieving the emission targets.

The last step would provide an estimate of the transition needed in the financial sector to meet the climate targets.

Deriving the estimates would require first, an analysis of the sources of finance for the transition to a low carbon economy: the domestic financial sector, government, self-financing by industry, and flows from abroad. And within the financial sector, an allocation between financial asset classes (loans, bonds, securities) and between the different financial intermediaries (banks, insurance, pension funds, asset managers, and other financial intermediaries). A flow of funds approach could provide the analytical framework.

Second, an analytical method for linking the loan and asset composition to emissions. For example, the IMF’s Global Financial Stability Report (October 2021) explores the role of investment funds in the transition to a low carbon economy. The analysis develops two key scores to summarize an investment fund’s exposure to a lower carbon economy and carbon intensity. Tolkki et al (2021) use granular data from Finland and show how it is possible to link the absolute level of emissions to bank lending to domestic non-bank financial corporations. Their paper also illustrates how the national emissions targets can be translated into targets for the carbon footprint of the loan portfolio. Faiella and Lavecchia (2020) estimate emissions in the loan portfolio using loan exposures to carbon critical industries.

One of the challenges in deriving the estimates would be financial flows through the unregulated sector. This sector could become increasingly important, especially if polices promote disintermediation from the regulated sector. This risk is already apparent in the role of venture capital in acquiring brown assets shed by publicly listed companies to meet shareholder climate risk concerns, and this may expand with the increased microprudential attention to climate-related risks in the regulated financial sector.

The assessments will require enhancements in data collection, including implementing the initiatives on taxonomies, disclosures and to fill the information gaps discussed in section 2. There would be a need to compile macro-financial data on carbon emissions by sectors and industries. There may also be a need for additional data disclosure and collection initiatives, such as a broader application of ESG scoring of investments and the development of scores to summarize exposures to carbon intensity.[30]

Policy uses of the assessments

The assessments could be used in different policy discussions and analysis on mitigating the risks of climate change.

First, by providing guidance on the magnitude of the necessary transition in the financial flows to meet the climate goals, the assessments would provide an input into financial stability reviews and macroprudential stress tests. Identification of the overall magnitude of the transition and its distribution across different intermediaries (banks, insurance, pensions, asset managers, and others) and asset classes would be a key component in the design of top-down stress tests, and also a useful reference for individual institutions stress tests. The stress tests could examine the potential feedback loops from the transition in different intermediaries and asset classes, adding a macroprudential perspective to the individual institution and intermediary sector stress tests.

Second, the assessments would provide a macroprudential perspective as an input to microprudential supervision. Macroprudential assessments can help guide risk-based supervision. The assessments of the necessary transition in financial intermediaries’ balance sheets and asset classes would provide a yardstick for the microprudential reviews, and complement the international standard setters’ microprudential recommendations on climate-related risks. The integration of macro and microprudential polices is discussed in Toronto Centre (2021a).

Third, the assessments would help to identify the need and urgency for additional public policy actions in the financial sphere to achieve the climate objectives. The policy actions could include the adoption of consistent carbon pricing in loan and asset evaluations as a first best solution. For example, the assessments might explore the progress in applying an appropriate shadow price for carbon in financial decisions.[31] Estimates are available of the shadow carbon price that is consistent with meeting the PCA emission goals. However, the application of carbon pricing in asset allocation decisions is highly uneven.[32]

Other policy actions could include the development and implementation of financial mechanisms which can both fill the climate financing gap and meet investors’ risk and return needs. The latter instruments include concessionary finance, loan guarantees, policy insurance, foreign exchange liquidity facilities, pledge funds, and subordinated equity.[33] Sustainability labeling has been shown to be an important driver of flows into sustainable investments.[34] The assessments could also help to frame a discussion on the use of specific macroprudential policy tools to address climate-related risks (see below).

Fourth, the assessments would be a check on the consistency of the overall climate strategy. In particular, by identifying the magnitude of the necessary transition in finance to meet the climate goals, the assessments would provide a guide to its feasibility and potentially destabilizing effects. For example, if the size of the adjustment in financial flows is assessed to be very large, this would be both a call to action and a warning that the financial transition to a low carbon emitting economy would be potentially destabilizing. These conclusions could then feed back into the design of the climate strategy.

Use of macroprudential policy tools to mitigate climate-related financial risks

A fifth policy area is the potential use of macroprudential tools to address climate-related financial risks. The considerations include the purposes and design of the tools, their likely effectiveness, and possible unintended consequences.

Macroprudential tools such as the CCyB and SIFI capital charges were designed following the GFC primarily to enhance the buffers against losses in the financial system that could create systemic risk.[35] These tools have a secondary benefit of leaning against the wind in helping to reduce the build-up of systemic risks – the growth of bank credit in the case of the CCyB and of discouraging SIFIs in the case of SIFI capital charges. Some other macroprudential tools, such as loan to value (LTV) and debt to income (DTI) ratios, are designed primarily to lean against the wind, while others such as adjustments in risk weights have objectives and benefits similar to the CCyB.

In the case of climate-related risks, where the losses are highly uncertain, the primary objective of the macroprudential tools would be to lean against the wind – to discourage brown financing and/or encourage green financing. A secondary benefit would be the creation of additional buffers against climate-related financial losses.

While using macroprudential tools to mitigate the risks of climate change is an attractive proposition, the application has difficulties:

- Instrument design: the CCyB and adjustments in risk weights were deigned to address bank specific sources of systemic risk – procyclical bank credit growth. Climate-related risks apply to insurers, pension funds and asset managers as well as banks and across all asset classes. A climate-related CCyB and risk weight adjustments would have to be designed to apply very broadly, and this imposes serious practical limitations.

- Effectiveness: the effectiveness of the CCyB and other tools in leaning against the wind is uncertain. There is an argument that given the magnitude of the climate-related financial risks nothing should be off the table even if the effectiveness is uncertain, but this begs the question of unintended consequences.

- Unintended consequences: the application of the tools to regulated financial institutions could accelerate the disintermediation of brown finance to the unregulated sector, which would not mitigate the systemic risk posed by climate change.

For the above reasons, the usefulness of specific macroprudential tools, or at least those that have been considered to date, in mitigating climate-related financial risks may be limited. The primary role of the macroprudential framework would be to identify the financial sector transition involved in meeting the climate goals, and thus to provide an input into the analysis of the financial stability risks of that transition, and to inform the broader policy responses to mitigate the risks posed by climate change.

Conclusions

Climate change poses a host of new challenges for macroprudential policy. In particular, there is a basic conundrum. The financial risks from climate change will materialize over long time horizons and involve complex non-linearities and tipping points, and their quantification involves extreme uncertainty. Nevertheless, there is a high degree of certainty that if climate targets are not met, the risks will materialize, most likely in the form of a catastrophic green swan event.

This Note proposes a framework for macroprudential policy makers to respond to the systemic risks posed by climate change. The framework involves some adaptation of the existing macroprudential frameworks to reflect the longer-term feedback loops between the financial system and climate change in creating systemic risk for the financial system.

The adapted framework focuses on the role of the financial system in achieving national climate goals as the best strategy to mitigate systemic risk in the financial system from climate change. The framework has the advantage of embedding the macroprudential framework in the national climate strategy, of complementing other initiatives to combat climate change, and helping to address the “tragedy of the horizon” in designing the macroprudential policy response.

The proposed framework would be an additional component of macroprudential and financial stability assessments. The results of the assessments would inform the analysis of the financial stability risks of the transition to a low carbon emitting economy, and the design of financial sector and broader policy responses. The macroprudential approach would complement microprudential initiatives.

Macroprudential analysis has adapted over time to address prescient financial stability concerns. The time seems ripe for another adaptation to reflect the very real financial stability challenges posed by climate change.

References

Bolton, P., Depres, M., Pereira da Silva, L. A., Samam, F. and Svartzman, R. The green swan. Central banking and financial stability in the age of climate change. January 2020.

Brunetti, C., et al. Climate Change and Financial Stability. FEDS Notes. March 2021.

Carbon Pricing Leadership Coalition. Report of High Level Commission on Carbon Pricing and Competitiveness. World Bank. 2019.

Carney, M. Breaking the Tragedy of the Horizon - Climate Change and Financial Stability. September 2015.

Demekas, D. and Grippa, P. Financial Regulation, Climate Change and the Transition to a Low-carbon Economy. IMF Working Paper 21/291. December 2021.

European Commission. Strategy for Financing the Transition to a Sustainable Economy. July 2021.

Faiella, I. and Lavecchia, L. The carbon footprint of Italian loans. Bank of Italy Occasional Paper 557. April 2020.

Financial Stability Board. Stocktake of financial authorities’ experience in including physical and transition climate risk as part of their financial stability monitoring. July 2020a.

Financial Stability Board. The Implications of Climate Change for Financial Stability. November 2020b.

Financial Stability Board. Road map to address climate related financial risk. July 2021.

Feyen, E. et al. Macro-Financial Aspects of Climate Change. World Bank Policy Research Working Paper 9109. January 2020.

Grippa, P., Schmittmann, J. and Felix Suntheim, F. Climate Change and Financial Risk. December 2019.

Grunewald, Seriana. Climate Change as Systemic Risk – are macroprudential authorities up to the task? EBI Working Paper 62. April 2020.

International Association of Insurance Supervisors. Application Paper on the Supervision of Climate-related Risks in the Insurance Sector. May 2021a.

International Association of Insurance Supervisors. The Impact of Climate Change on the Financial Stability of the Insurance Sector. September 2021b.

International Organisation of Securities Commissions. Sustainable Finance and the Role of Securities Regulators and IOSCO. April 2020.

International Monetary Fund, Bank for International Settlements and Financial Stability Board. Guidance to Assess Systemically Important Financial Institutions, Markets and Instruments: Initial Considerations. October 2009.

International Monetary Fund. Global Financial Stability Report. Chapter 3. October 2021.

Johnston, R. Barry and Sundararajan, V. Sequencing Financial Sector Reform: Country Experiences and Issues. International Monetary Fund. 1999.

Johnston, R. Barry, Chai, J. Schumacher, L. Assessing financial system vulnerabilities. IMF Working Paper 00/76. April 2000.

Network of Central Banks and Supervisors for Greening the Financial System. A Call for Action: Climate Change as a Source of Financial Risk. April 2019.

Network of Central Banks and Supervisors for Greening the Financial System. Guide to Climate Scenario Analysis for Central Banks and Supervisors. June 2020a.

Network of Central Banks and Supervisors for Greening the Financial System. Climate Scenarios for central banks and supervisors. June 2020b.

Network of Central Banks and Supervisors for Greening the Financial System. Climate Scenarios for central banks and supervisors. June 2021a.

Network of Central Banks and Supervisors for Greening the Financial System. Progress Report on the Guidance for Supervisors. October 2021b.

Nieto, M. Banks, climate risk and financial stability. Journal of Financial Regulation and Compliance, V. May 2019.

Pereira da Silva, L. Research on climate-related risks and financial stability: An "epistemological break"? Remarks at the Conference of the Central Banks and Supervisors Network for Greening the Financial System. April 2019.

Task Force on Climate-related Financial Disclosures. Recommendations of the Task Force on Climate-related Financial Disclosures, Final Report. June 2017.

Toronto Centre. Integrating Micro Prudential Supervision with Macroprudential Policy. March 2021.

Toronto Centre. A Climate Risk Toolkit for Financial Supervisors. September 2021.

Tolkki, V., Hirvonen, A. and Karhu, A. Carbon Footprint of Bank Loans to Domestic Non-Financial Corporations. Paper presented to 9th IMF Statistical Forum: Measuring Climate Change: The Economic and Financial Dimensions. November 2021.

UNFCC. The Paris Agreement. December 2015.

World Bank. Shadow Price of Carbon in Economic Analysis. November 2017.

[1] This Note was prepared by R. Barry Johnston.

[2] FSB (2020b).

[3] NGFS (2019).

[4] BCBS (2021), IAIS (2021a), IOSCO (2020), and Toronto Centre (2021b).

[5] Bolton et al (2020), Demekas and Grippa (2021), and Gruenwald (2020).

[6] Grippa et al (2019).

[7] See FSB (2020a) and Brunetti et al (2021).

[8] FSB (2021).

[9] IMF et al (2009).

[10] Toronto Centre (2021a).

[11] FSB (2020b) discusses the numerous channels through which climate change could have an impact on financial stability.

[12] There are of course exceptions as some companies seek to include shadow prices for carbon in their investment decisions. For a full discussion see Carbon Pricing Leadership Coalition (2019).

[13] The TCFD was set up in 2015 by the Financial Stability Board (FSB), see www.fsb-tcfd.org

[14] TCFD (2017); http://www.sasb.org/

[15] Pereira da Silva (2019).

[16] NGFS (2020a, 2020b, and 2021a).

[17] See IAIS (2021a) for an example of the application of these scenarios to valuing the asset portfolios of insurance companies.

[18] Bolton et al (2020).

[19] BCBS (2021).

[20] IAIS (2021a).

[21] IOSCO (2020).

[22] NGFS (2021b).

[23] Toronto Centre (2021b).

[24] FSB (2021).

[25] Ibid page 29.

[26] Bolton et al (2020), Nieto (2019) and Grunewald (2020). Climate-risk adjusted capitlal requirements would be considered a macroprudential tool when they are designed and applied to address the risk to the financial system as a whole rather than the risk of exposures on an individual bank’s balance sheet. They could also be extended to the risk weighting of assets on insurance companies’ balance sheets as part of a solvency ratio calculation.

[27] Grunewald (2020).

[28] Johnston and Sundararajan (1999).

[29] Johnston et al (2000).

[30] IMF (2021).

[31] World Bank (2017).

[32] Carbon Pricing Leadership Coalition (2019).

[33] See Feyen et al (2020) and European Commission (2021).

[34] IMF (2021).

[35] Toronto Centre (2021a).