|

|

| Timothy Adams and Bill Coen |

Martin Moloney and Clive Briault |

|

|

| Paul Wright and Clive Briault |

Dr. David Nabarro, Stefan Ingves, and Socorro Heysen |

|

|

| Timothy Antoine and Greta Bull |

Dr. Reza Baqir and Ceyla Pazarbasioglu |

|

|

|

| John Rwangombwa and Conor Donaldson |

Ernest Addison and Christopher Calabia |

|

Dr. David Nabarro, Stefan Ingves, and Socorro Heysen

|

The Honourable Sri Mulyani and Dr. Carmen Reinhart. Moderated by Susanna Moorehead

|

|

Carolyn Rogers and Paul Andrews

|

Executive Panel at the IMF/WB Virtual Spring

|

|

Jameel Ahmad, Kevin Cowan Logan, and Clive Briault

|

Pei Hong Mok and Alejandra Olivares

|

|

Maurene Simms and Kuben Naidoo

|

Elsie Addo Awadzi, Martin Moloney, and Lyndon Nelson

|

|

Executive Panel at the IMF/WB Virtual Annual Meetings 2020

|

Babak Abbaszadeh and Gerry Lewis

|

|

|

|

|

This podcast will focus on the recent TC Notes on recovery and resolution planning, and will discuss implications for supervisors should an institution fail.

|

|

Mariela Zaldivar, Superintendente Adjunto de Conducta de Mercado e Inclusión Financiera de la Superintendencia de Banca, Seguros y AFP (SBS) del Perú, nos comenta sobre los problemas que enfrenta la población más vulnerable en el Perú ante la actual coyuntura, cuál ha sido la respuesta de la SBS y cómo la crisis ha cambiado el trabajo del supervisor de conducta y sobre la importancia de una estrecha cooperación con el supervisor prudencial.

|

|

All companies are determining the best way to reintegrate employees back to the office. This podcast will share information and practical tips to help supervisors and regulators not only survive but to also thrive as they transition back to the office.

|

|

In this episode, Chuin Hwei Ng interviews long-time TC partner Gerry Lewis on questions such as: how do we make sure the work still gets done effectively? Will my team be as productive or as efficient? How will we stay connected as people – and as a functioning team?

|

|

In this podcast, Jean Lorrain, Chair of Toronto Centre’s Securities Advisory Board, discusses the implications of COVID-19 and climate risk for securities regulators, the usefulness of international standards, and “staying the course” in the new normal.

Dans ce podcast, Jean Lorrain, président du Conseil consultatif sur les valeurs mobilières du Toronto Centre, discute des répercussions de la COVID-19 et du risque climatique pour les organismes de réglementation des valeurs mobilières, de l’utilité des normes internationales et comment maintenir le cap dans la nouvelle normalité.

|

|

Anatol Monid, Toronto Centre Program Director, sits down with Dr. Naresh Singh, Special Advisor Sustainability at Toronto Centre, to discuss the risks to the financial system posed by climate change and what supervisors can learn from the COVID-19 pandemic to better address climate change disruptions.

|

|

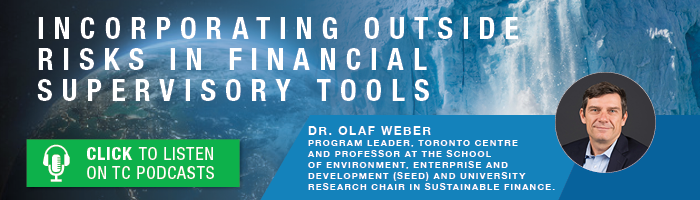

Discussion with Dr. Olaf Weber, Toronto Centre Program Leader, Professor at the School of Environment, Enterprise and Development (SEED) and Research Chair in Sustainable Finance at the University of Waterloo highlights the importance of broadening existing financial supervisory tools to incorporate risks outside the financial sector such as COVID-19, climate change and other events as they have material impact on the economy and the financial industry.

|

|

John Pattison, Toronto Centre Program Leader highlights some of the supervisory challenges during and after a very peculiar crisis like COVID-19, and what financial supervisors and regulators should focus on as they operate in this new normal.

|

|

Jorge Mogrovejo, Superintendente Adjunto de Banca y Microfinanzas de la Superintendencia de Banca, Seguros y AFP sobre la situación en el Perú y las medidas regulatorias y de supervisión que se han tomado para manejar la crisis.

|

|

Mutumboi Mundia, Director – Market Supervision and Development and Mubanga Kondolo, Manager – Financial Inclusion at the Securities and Exchange Commission Zambia discuss how financial supervisors and regulators are navigating the current global pandemic crisis whilst continuing and leveraging opportunities for the national financial inclusion agenda, and in particular in Zambia.

|

|

Dr. Hoe Ee Khor, Chief Economist of the ASEAN+3 Macroeconomic Research Office (AMRO) discusses the key findings from its flagship report, the ASEAN+3 Regional Economic Outlook 2020 on the impact of the COVID-19 pandemic on Asia’s economic outlook and financial stability Dr. Hoe Ee Khor, Chief Economist of the ASEAN+3 Macroeconomic Research Office (AMRO) discusses the key findings from its flagship report, the ASEAN+3 Regional Economic Outlook 2020 on the impact of the COVID-19 pandemic on Asia’s economic outlook and financial stability

|

|

Max McConnell, Psychotherapist and Registered Social Worker, offers some strategies for financial supervisors to deal with the stress and widespread disruption to their professional and personal lives during the COVID-19 pandemic.

|

|

Gerardo Hernández, Co-Director del Banco de la República (Colombia), presenta las respuestas de política que han tomado las autoridades colombianas para enfrentar la situación creada por la Pandemia del COVID-19 y sus limitaciones en una economía emergente

|

|

|

|

Juan Pedro Cantera, Superintendente de Servicios Financieros de Uruguay, presenta las respuestas de política que han tomado las autoridades uruguayas y del sur del continente para enfrentar la situación creada por la Pandemia del COVID-19

|